unemployment tax refund how much will i get back

People might get a refund if they filed their returns with the IRS before Congress passed the law exempting a portion of unemployment payments from tax. IR-2021-151 July 13 2021.

H R Block Good News Up To 10 200 Of Your Unemployment Income Could Be Tax Free The Irs Will Automatically Adjust Your Taxes And Any Refunds Will Start Going Out In May

If I Paid Taxes On Unemployment Benefits Will I Get A Refund Congress made up to a 10200 in jobless benefits payment in 2020 tax-free for people earning less than 150000 a year.

. How much you will receive depends on how much you paid in taxes on your unemployment income in 2020. It is not your tax refund. The total amount of the unemployment tax break refund is 10200.

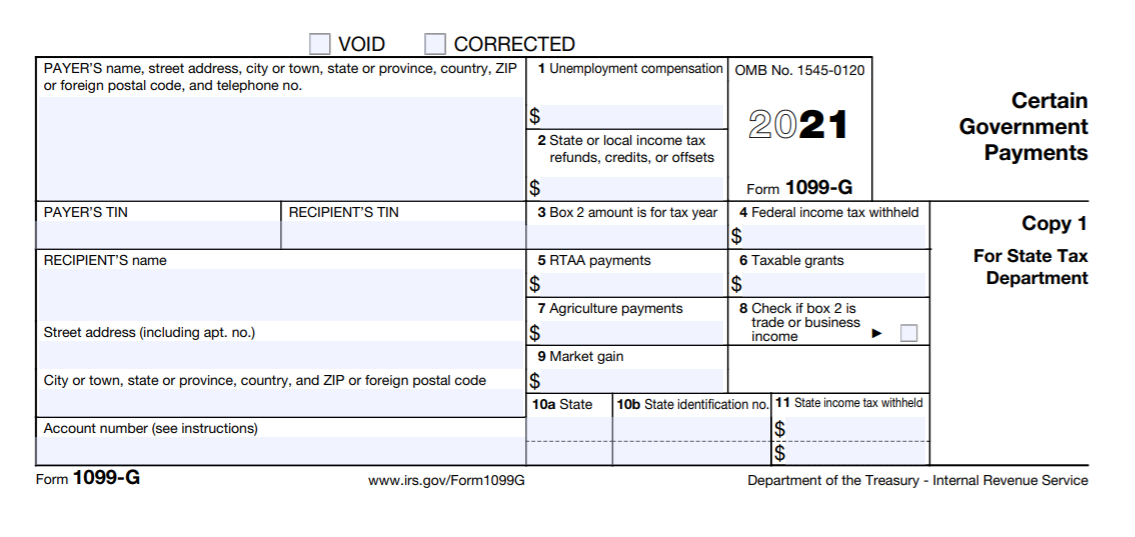

Lets say your employer withheld 6000 in taxes this year to pay to the IRS on your behalf. This is an optional tax refund-related loan from MetaBank NA. WASHINGTON The Internal Revenue Service announced today it will issue another round of refunds this week to nearly 4 million.

Depending on how much you received in benefits last year along with your income and filing status you could see a refund of 1000. If your modified adjusted gross income is less than 150000 the American Rescue Plan Act enacted on March 11 2021 allows you to exclude from income up to 10200. Americans who collected unemployment benefits last year could soon receive a tax refund from the IRS on up to 10200 in aid.

The American Rescue Plan Act of 2021 changed the tax code so that the first 10200 of unemployment benefits you received in 2020 is free of federal taxes. This handy online tax refund. Irs Sends 430000 Refunds For Unemployment Tax Compensation Who Will Receive Roughly 1189.

The legislation signed on March 11 allows taxpayers who earned less than 150000 in modified adjusted gross income to exclude unemployment compensation up to. If the amount of unemployment repayment is 3000 or less deduct it on Schedule A in the year you repaid. Subtract the 4295 in taxes you owe from the 6000 withholdings and you can estimate a refund of about 1705 for.

TWC accepts payments for an unemployment benefit overpayment online by E-check or by mail. Approval and loan amount. How much will I get back from unemployment tax break.

The tax agency says it recently sent refunds to another 430000 people who. You can find this number on your W-2. Loans are offered in amounts of 250 500 750 1250 or 3500.

However the refund amount may vary depending on your income state of residence and the number of. The next wave of payments is due to be made at some point in mid-June but until then you may be able to work out how much you will receive. The deduction is subject to the limit of 2 of your adjusted gross income AGI.

We cannot accept payment by phone debit card credit card or PayPal. IRS sends out another 430000 refunds for 2020 unemployment benefit overpayments. According to the IRS the average refund is 1686.

In its most recent press release the Internal Revenue Service announced it sent approximately 430000 refunds to those who paid taxes on unemployment compensation that is now excluded for the income tax year 2020 under the stimulus relief bill. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189 to filers who paid too much in taxes for their 2020 unemployment benefits.

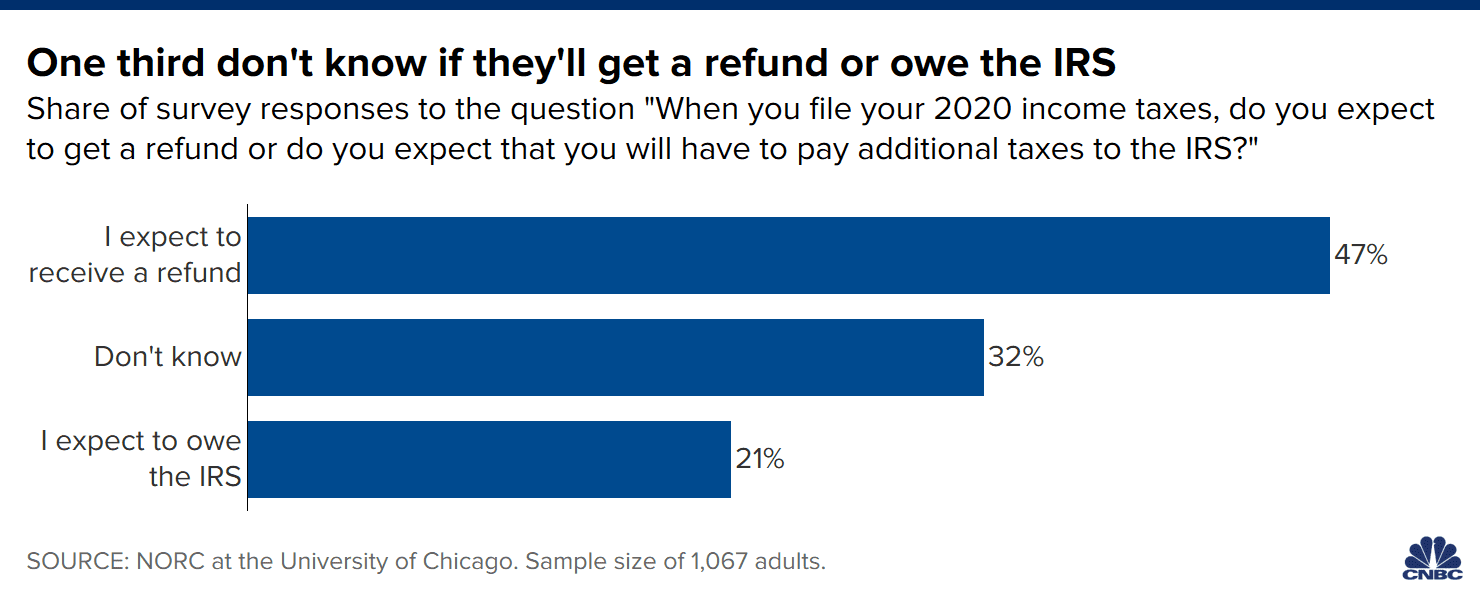

Will You Get A Tax Refund Or Owe The Irs 32 Of Americans Don T Know

Millions Might Get A Refund With The 10 200 Unemployment Tax Break But Filing An Amended Return Could Unlock Even More Money Marketwatch

H R Block Turbotax Help Filers Claim 10 200 Unemployment Tax Break

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

More Irs Refunds Are On The Way How Unemployment Figures In Wfmynews2 Com

When To Expect Unemployment Tax Break Refund Who Will Get It First As Usa

Questions About The Unemployment Tax Refund R Irs

Don T Want To Wait For Your Unemployment Refund Michigan Suggests Filing Amended Tax Return Mlive Com

Irs Tax Refund Tips To Get More Money Back With Write Offs For Unemployment Loans And More Abc7 Chicago

No Tax Refund Yet Why Your Irs Money Might Be Late Cnet

Where S My Refund Tax Refund Tracking Guide From Turbotax

Unemployment Tax Refund How To Calculate How Much Will Be Returned As Usa

Oregon Irs Will Automatically Adjust Returns For Those Who Paid Taxes On Unemployment Benefits Oregonlive Com

Waiting For Your Unemployment Tax Refund About 436 000 Returns Are Stuck In The Irs System The Us Sun

Don T Count On That Tax Refund Yet Why It May Be Smaller This Year

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

Filing Taxes In New York Here S What You Need To Know

Irs Says Unemployment Refunds Will Start Being Sent In May How To Get Yours Mlive Com