lake county indiana tax warrants

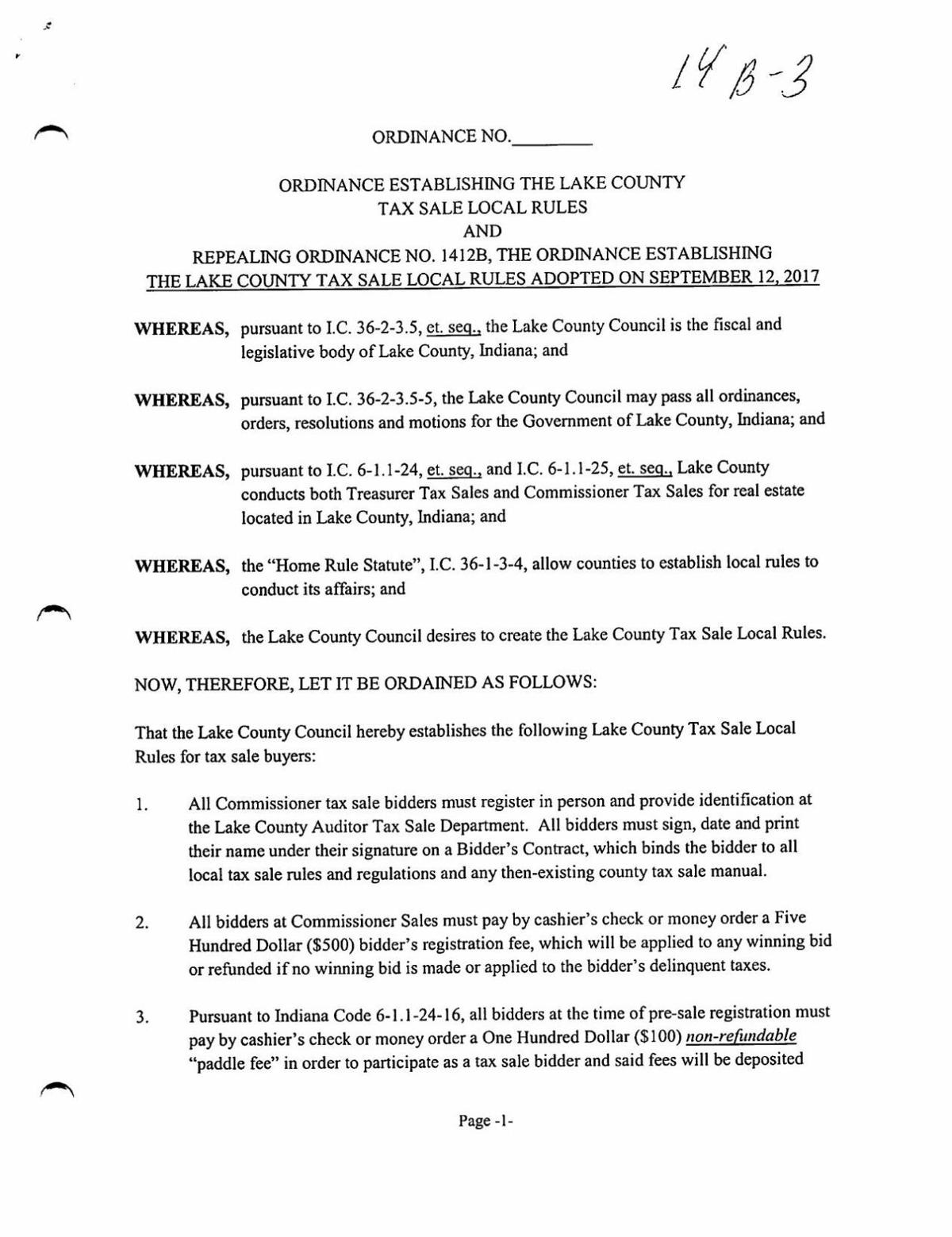

Are delinquent on their state taxes. In mid July taxpayers are sent a demand letter by certified mail for payment of delinquent taxes and penalties for the prior year.

Marion County Sheriff S Office In Mcso In Twitter

A Lake County Warrant Search provides detailed information on whether an individual has any outstanding warrants for his or her arrest in Lake County Indiana.

. Eligible taxpayers may request a tax warrant expungement for tax liabilities that. SF 56196 Expungement Request Form. -Issuing TAX WARRANTS on behalf of the State and collecting monies from those who.

Requesters can visit the clerks office in their county area to find out if they have a warrant. The Sheriff of Porter County is authorized to collect taxes due to the State of Indiana. Alternatively a county sheriffs department may provide a warrant search website to the public.

Taxpayers are given thirty 30 days to make. With a subscription to the Tax Warrant Application on INcite managed by the Office of Trial Court Technology users can get secure. In order to search for active arrest warrants in Lake County Indiana you can either physically go to your local police department pay a small fee and get the report you need not the best.

You may pay your property tax bill online by clicking the Pay Online link OR at selected banks from October 3 2022 to November 10 2022. Find Lake County Indiana tax warrant and lien information by delinquent tax payer name and case number. The Lake County Sheriffs Office maintains the constitutional and statutory requirement to enforce criminal warrants directed by the Lake County Circuit Court.

Awarded Lake County Indiana the County. The inmate roster online public request an active warrants in whitley county fields below. Enter and clear both misdemeanor and felony warrants into IDACSNCIC and.

User Agreement for e-Tax Warrant Search Services Contact Information For more information contact LaJuan Epperson at lajuaneppersoncourtsingov 317-234-2870 or toll free 888. The Lake County Civil Sheriff has three 3 offices. Subscribe to Search Indianas Tax Warrant Database.

Warrants The Warrant Division of the Lake County Sheriff Department is responsible for the following duties. These warrants may be. Main Street Crown Point IN 46307 Phone.

Building A 2nd Floor 2293 N. These warrants could be for individual income sales withholding or from. If you wish to dispute the amount owed please contact the Indiana Department of.

Main Street Crown Point IN 46307 Phone. As part of our commitment to provide our customers with efficient and convenient service The Treasurers Office now offers tax payments over the Internet using major credit cards and e. Learn about Warrant Searches disable any ad blockers Lake County in the state of Indiana.

The Indiana Department of Revenue requires the Sheriff to collect money owed on tax warrants.

City Council Approves Tax Breaks For Catalent Putting Investment Decision In Company S Hands Indiana Daily Student

Lake County Tax Sales Invest Nwi Discount Real Estate In Northwest Indiana

St Louis Sheriff S Deputies Get Certified To Patrol The Streets Ksdk Com

Dor Unemployment Compensation State Taxes

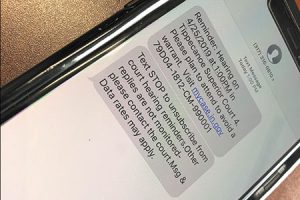

Tax Warrant Scam Is Hitting Central Indiana Wthr Com

La Porte County Sheriff S Office

![]()

Taxpayer S Guide To Indiana Dor Tax Warrants

Scam Alert Fraudulent Tax Letters Claiming Distraint Warrant Cattaraugus County Website

Rabine Blames 2017 Tax Lien On Ides Pledges To Pay Legitimate Debt Wgn Radio 720 Chicago S Very Own

New Lake County Tax Sale Rules Win Final Approval

Franklin County Sheriff Department

![]()

Taxpayer S Guide To Indiana Dor Tax Warrants

Home Elkhart County Sheriff S Office

.png/:/)